Married Women’s Property (MWP) Act in Term Insurance

One of the primary reasons to buy life insurance such as a term plan is to safeguard the financial interest of your loved ones in the case of your unexpected demise. One of the ways in which a legal sa

Written by

Reviewed by

Vaibhav Kumar

Insurance Expert

With over 15 years in life insurance, Vaibhav is a recognized products and digital leader for driving innovation at Axis Max Life. He's played a pivotal role in developing new business lines and implementing successful D2C strategies.

What is the Married Women’s Property (MWP) Act, 1874?

The Married Women's Property Act or MWP Act was first passed in 1874 and has undergone a number of amendments to expand its scope through the years. In its current form the act is designed to provide dependent married women with complete ownership of wages, property, savings, investments and earnings of their husbands. The main purpose of the MWP Act is to ensure the financial protection of women such as wives, mothers, daughters or sisters who are partially or wholly dependent on the earning male members of the family.

The 1923 amendment of the Act expanded the original scope of legal protection to include death and maturity benefits of life insurance policies in India. There are 2 separate sections of the Married Women's Protection Act that have significance with respect to life insurance policies in India ; Section 5 and Section 6.

Section 5 of the MWP Act features a provision that allows a married woman to purchase life insurance by herself. This means that a policy purchased under Section 5 of the MWPA ensures that the married woman and her nominees will have sole authority over any and all benefits provided under the policy. Currently this provision can be availed only by married Christian women.

Additionally, Section 6 of the MWP Act makes it legally binding that death or maturity benefits of a life insurance policy bought by a married man (including widower or divorcee) with the MWP addendum are the sole property of the nominated beneficiaries such as spouse, dependent children, etc.

Furthermore, the payout is treated separate from the estate of the policyholder. So the payout of life insurance policies including term plans covered under the Married Women's Property Act cannot be attached by creditors to repay outstanding debts or loans in the event of the policyholder's untimely demise. This legal protection is designed to minimize the financial or legal hardship that various financial dependents of the policyholder including homemakers with no alternate source of income might face after their husband's death.

Benefits of Policy Covered by MWPA

Below are the key benefits that married women and/or dependent children receive from a policy purchased with the MWPA addendum:

What is the Married Women’s Property Act (MWPA) Addendum?

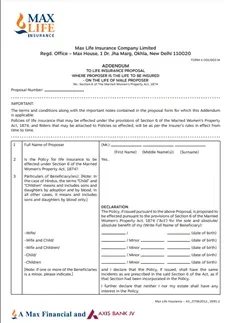

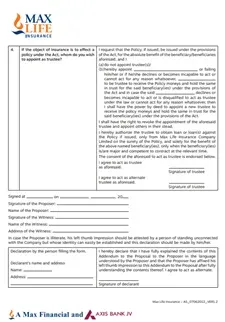

In order to receive the benefits under MWPA, the life insurance policy applicant needs to fill out a form known as the MWPA addendum along with the life insurance policy documentation to ensure that dependents such as their spouse and children get the legal protection provided by the Married Women's Property Act. Currently 2 different variants of the addendum are used by life insurance companies in India ; one for male proposer and the other for female proposer.

The MWPA addendum form for male proposer looks like this:

There is also a similar but separate form in use, known as the MWPA Addendum for female proposer"rel="noreferrer" target="_blank" class="underline cursor-pointer text-link-secondary" addendum. This addendum form needs to be filled out by women who are purchasing life or term insurance policies covered under Section 5 of the MWP Act.

Upon purchase of a term insurance policy with the MWPA addendum, the death and/or maturity benefits of the eligible life insurance policy cannot be claimed by any person including the policyholder as the payout beneficiary can only be the spouse and/or dependent children of the policyholder.

Parents of the policyholder also cannot be beneficiaries of such MWPA-covered life insurance policies. One should also note this addendum has to be filled out and submitted at the time of policy purchase, under current rules it cannot be submitted for existing policies or amended by the policyholder at a later date.

Who is Eligible to Purchase a Policy Covered by MWPA?

A life insurance policy secured by the Married Women’s Property Act, 1874 can be purchased by any married man or woman in India including widower and/or divorcee. Some common types of applicants who should consider purchasing MWPA life policies in India include:

For all the above types of applicants, the goal is to ensure the financial protection of their dependent spouse and/or dependent children if the unforeseen happens.

Who can be Beneficiaries of a Life Insurance Policy under the MWP Act?

The MWP Act also specifies individuals who are allowed to be beneficiaries of an eligible life insurance policy. Potential beneficiaries of these policies include:

As you can see, MWPA does not allow even other close family members like parents and siblings of the policyholder to become beneficiaries of life insurance policies. What's more the policyholder himself cannot be the beneficiary in this type of insurance policy.

Conclusion

The key goal of the MWP Act in life insurance plans is focused on minimizing the financial hardship of family members like dependent wife and children in the case of the unexpected demise of the family’s earning member. But the actual scope of the act is much wider and helps legally enforce many other financial rights of women in India.

Frequently Asked Questions

When was the MWP Act brought into effect?

Which Section of the Married Women’s Property Act includes provisions for life insurance policy payouts?

Who Should opt for purchase of life insurance under the MWP Act?

Apart from Life Insurance under MWP Act, what are assets enjoy protection from attachment?

ARN: Sep23/Bg/25M

https://cleartax.in/s/atal-pension-yojana-apy-calculator

https://www.bajajfinservmarkets.in/insurance/term-insurance-plans/articles/married-womens-act-mwp-act.html

https://www.livemint.com/insurance/news/why-married-people-should-buy-term-insurance-under-mwp-act-11622475577202.html

https://economictimes.indiatimes.com/tdmc/your-money/what-all-married-women-should-know-benefits-of-husband-buying-a-policy-under-mwpa/articleshow/49469332.cms

https://www.bajajfinservmarkets.in/insurance/term-insurance-plans/articles/married-womens-act-mwp-act.html

https://www.indmoney.com/articles/insurance/married-womens-property-act-in-indial

https://www.indiacode.nic.in/show-data?actid=AC_CEN_3_20_00037_187403_1523269675897&orderno=6

https://m.economictimes.com/wealth/insure/life-insurance/how-married-womens-property-mwp-act-can-protect-financial-future-of-women-with-life-insurance-policies-even-when-nominations-fail/articleshow/108328848.cms

https://www.livemint.com/money/personal-finance/epf-ppf-among-assets-that-enjoy-legal-protection-from-court-attachment-1556706885816.html

https://www.lifeinscouncil.org/consumers/Benefits

Popular Searches

- Whatsapp: 7428396005Send ‘Quick Help’ from your registered mobile number

- Phone: 0124 648 890009:30 AM to 06:30 PM

(Monday to Sunday except National Holidays) - service.helpdesk@maxlifeinsurance.comPlease write to us incase of any escalation/feedback/queries.

- Whatsapp: 7428396005Send ‘Hi’ from your registered mobile number

- 1860 120 55779:00 AM to 6:00 PM

(Monday to Saturday) - service.helpdesk@maxlifeinsurance.comPlease write to us incase of any escalation/feedback/queries.

- 011-71025900, 011-61329950(9:30 AM to 6:30 PM IST Monday to Saturday)

- nri.helpdesk@maxlifeinsurance.comPlease write to us incase of any escalation/feedback/queries.