Swati Saini

Firstly this plan offers a guaranteed interest rate, which means that I know exactly how much money my savings will earn each year. This gives me peace of mind knowing that my money is growing. The website showcased all the features and benefits of the plan clearly and whole journey of buying it online was quite seamless.

Tanu Singh

SFRD plan gives guaranteed returns which are fixed, and it's interest rate doesn't change like FD. Additionally, I got the benefit of a life cover. The website is self explanatory and the online journey is smooth. Axis Max life advisor helped me to choose the suitable plan as per my requirements.

Written by

Reviewed by

What is an Investment Calculator?

An investment calculator is an effective tool that allows you to get an idea of the returns on investment from a specific instrument or plan. This is one reason why they are also called Return on Investment (RoI) calculators.

Investment calculators are designed to provide potential investors with an estimate of the returns they can expect. For example, an investment calculator helps you estimate the benefits you will receive under the plan you choose, the amount to be invested, payment tenure, and frequency. However, investment returns are not guaranteed by such an online tool.

How to use an Investment Calculator?

Before you dive deep into how to use an investment calculator, you must know that different calculators are designed to work differently. You can find investment calculators online on the official websites of insurance companies and many others. The working mechanism of an investment calculator may also differ based on the products being sold through it.

It is simple and easy to calculate investment returns with the help of an online investment calculator. You can use the investment calculator by following these simple steps:

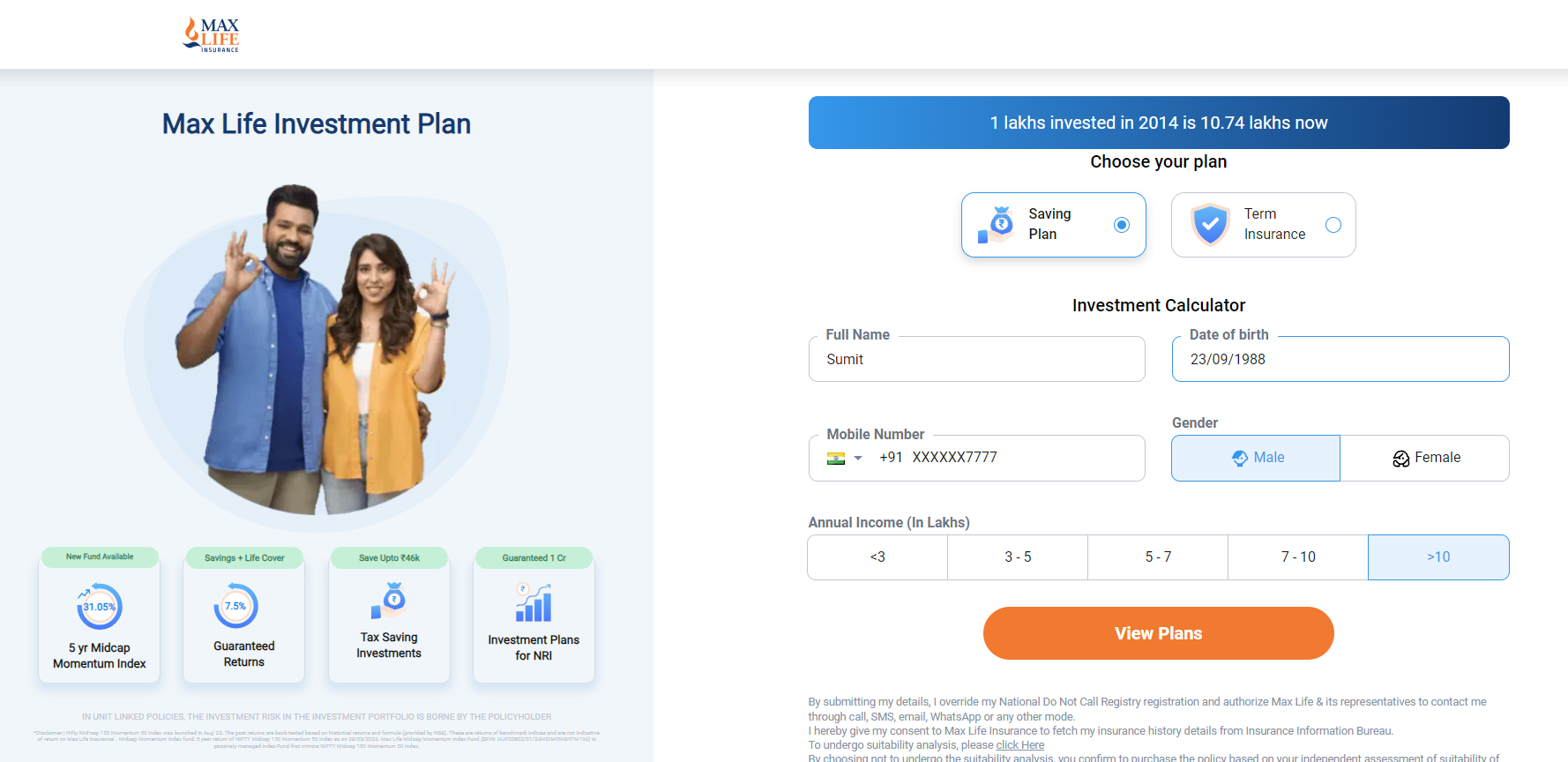

Step 1: Fill in your personal details like full name, date of birth, mobile number, gender, annual income and click on the ‘Check Returns’ button below.

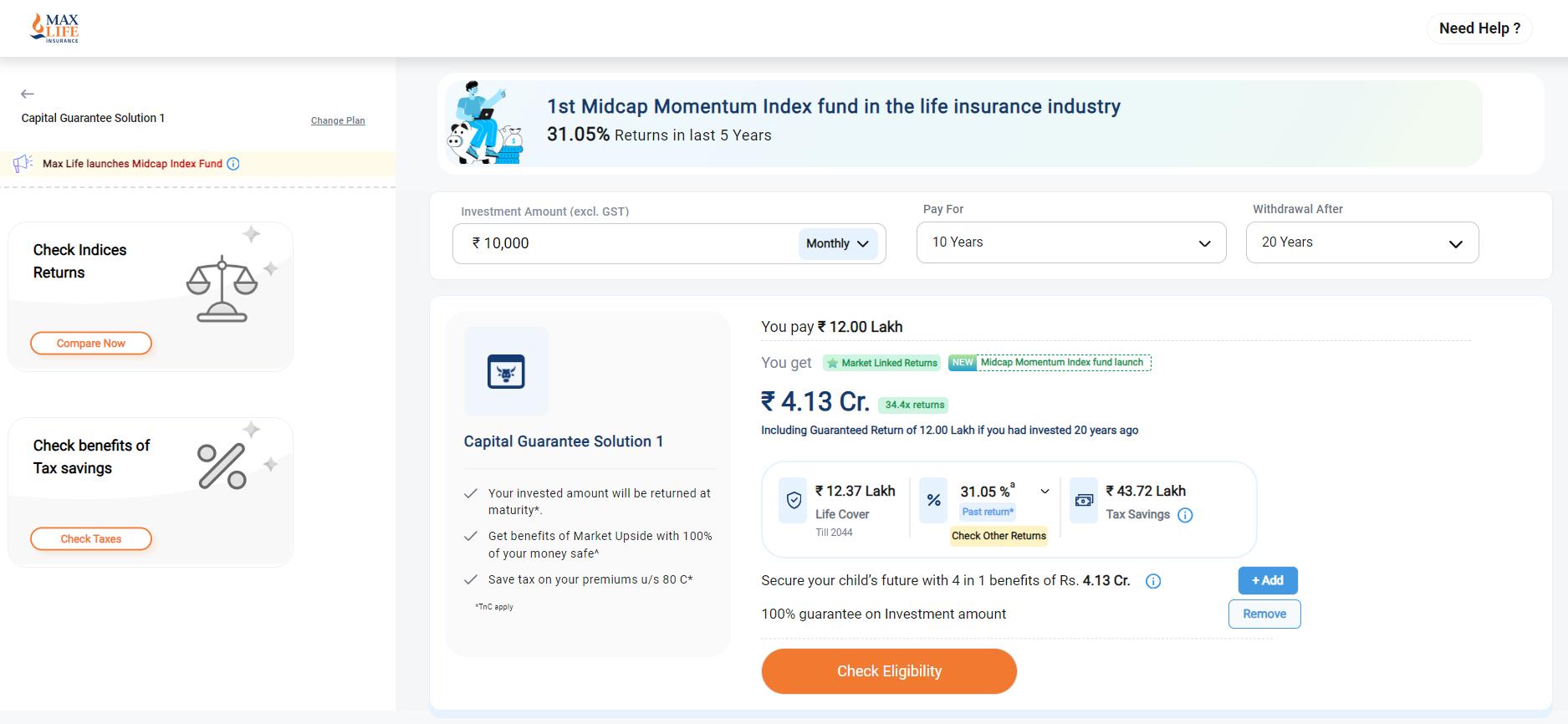

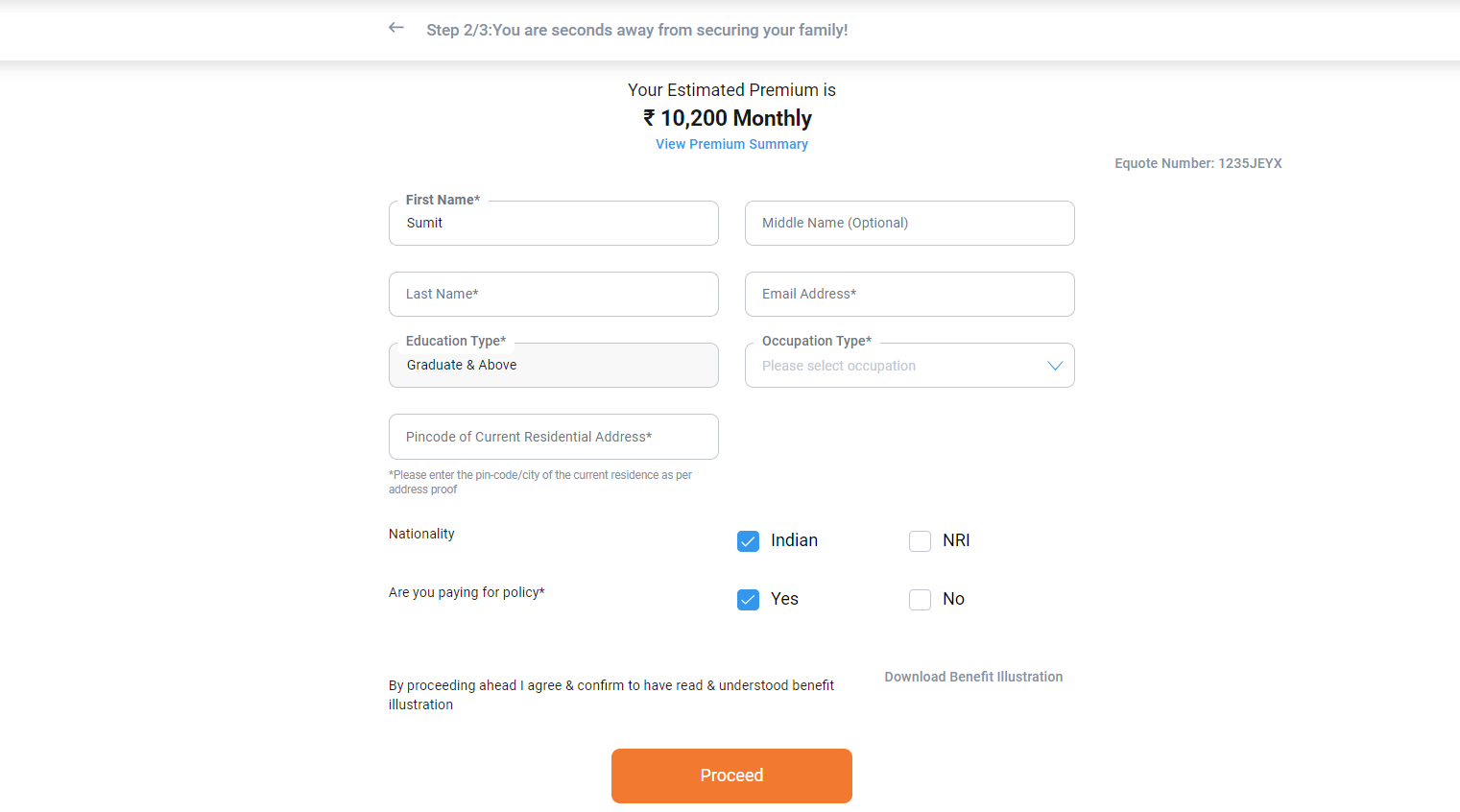

Step 2: Now, select your Educational Qualification, select the right plan for you, and then a right income option.

Step 3: On the next page, select an amount and its corresponding frequency to invest, premium payment term, and income duration, and you will see the key benefits like Life Coverage, Past Returns, and Tax Savings.

Step 4: Now, click on the ‘Check Eligibility’ button to proceed and provide your additional details to continue your investment journey.

The final screen also shows the total investment amount, standard rate of return as per your plan, some of the features of the plan you have selected and the maximum amount of tax you can save.

Variables involved in Investment Calculator

The following are the variables involved in the investment calculator:

Starting amount - Sometimes also referred to as the principal amount, it is the initial amount of the investment.

Return rate - It is the rate at which your investment can grow. For the purpose of illustration, the rate of returns is standard at 4% and 8%.

Investment duration - The duration of the investment refers to the time period of the investment.

Maturity amount - It refers to the amount at the maturity of an investment. It depends on the inputs of the other variables.

Withdrawal duration - It refers to the time period after which you wish to withdraw.

Compound Interest Calculation

The calculation of compound interest using a compound interest calculator is simple and easy, as it eliminates the need for manual complex calculations. This online tool can be used to determine the returns on investments, such as mutual funds, over a long time.

The calculation of compound interest requires three components – the principal amount, rate of interest, and span of time (typically in years) for which the money stays invested. The calculator allows you to enter the principal amount, compounding frequency, rate of interest, and time period. In a fraction of time, the calculator will display the amount of money you will earn as the interest on your investment, as well as the maturity amount.

Here is the compound interest calculation formula: A = P(1 + r/n)nt

Here, A refers to the future value of the investment; P refers to the principal amount to be invested; r refers to the rate of interest; n refers to the number of times the interest gets compounded annually; t refers to the tenure (in years) of investment.

Let us calculate compound interest of an investment of 10,000 for 10 years at an annual rate of interest of 7%.

A = 1000(1 + 7/1)(12 x 10)

The following table depicts the returns on your investment:

| Start Investing | Age 34 |

|---|---|

| Invested Amount | ₹ 10,000 |

| Invested Period | 10 Yrs |

| Total Investment | ₹ 12.00 Lakhs |

| Returns at the Age 44 | ₹ 17.41 Lakhs |

In just 10 years, your invested amount grows by 45%.

Types of Investment Calculators

Investment calculators can be of different types based on how you would like to invest your money. The following are two common and most relevant types of investment calculators:

One-time or Lumpsum Investment Calculator

One-time investment calculator allows you to calculate or project the overall returns on your single investment, and it is ideal for those who wish to invest their money in one go and reap higher returns on their idle money.

| Lumpsum Amount | Duration | Returns | Total Invested | Maturity Amount* |

|---|---|---|---|---|

| 1 Lakh | 20 Years | 15% | 1 Lakh | 16.37 Lakhs |

| 1 Lakh | 20 Years | 20% | 1 Lakh | 38.34 Lakhs |

| 1 Lakh | 20 Years | 25% | 1 Lakh | 86.74 Lakhs |

| 1 Lakh | 20 Years | 30% | 1 Lakh | 1.90 Cr |

Monthly Investment Calculator (Systematic Investment Calculator)

Systematic investment calculator allows you to calculate or project the overall returns on your regular investments, such as an SIP in mutual funds. This calculator is ideal for regular investors and plan to contribute on a monthly basis.

| Invested Amount | Investment Duration | Additional Waiting Time | Returns | Total Invested | Maturity Amount* |

|---|---|---|---|---|---|

| 10K/Month | 10 Years | 10 Years | 15% | 12 Lakhs | 1.24 Cr |

| 10K/Month | 10 Years | 10 Years | 20% | 12 Lakhs | 2.78 Cr |

| 10K/Month | 10 Years | 10 Years | 25% | 12 Lakhs | 6.33 Cr |

| 10K/Month | 10 Years | 10 Years | 30% | 12 Lakhs | 14.57 Cr |

*Disclaimer: The numbers shown in the above tables are for illustration purpose only and do not represent real-world returns of any products of Axis Max Life Insurance.

Benefits of using Investment Calculator

A return on investment calculator shows an estimate of the returns you can receive on the investment. Knowing this is important as any investment decision impacts your overall financial planning in the big picture.

Investment calculators for different instruments also give you a better idea about their suitability for your financial goals. Particularly for risk-averse investors, an investment calculator holds significant value as it helps them find safe investment options. Also, the results shown by an online investment calculator are more accurate than manual calculations.

BENEFITS

Why Prefer Axis Max Life?

99.65%

Claims paid percentage

(Source : Individual Death Claim Paid Ratio as per audited financials for FY 2023-2024)

₹1,779,409 Cr.

Sum Assured

In force (individual) (Source : Axis Max Life Public Disclosure, FY 2023-24)

₹150,836 Cr.

Assets Managed

(Source : Axis Max Life Public Disclosure, FY 2023-24)

304 Offices

Axis Max Life Presence

(Source : As reported to IRDAI, FY 2023-24)

Empathy

For our customers

Transparency

In all phases

Smart Investment options in India

- Mutual Funds -Mutual Funds are investment schemes that are professionally managed by mutual fund manager. Investments from large number of investors are pooled and invested in multiple investment instruments under the specific mutual fund scheme. Mutual Funds in India are governed by SEBI (Securities Exchange Board of India) guidelines.

- SIP -SIP or Systematic Investment Plan allows investors to invest a small amount in regular intervals in a specific mutual fund. SIP comes in handy for investors who want to invest in a periodic fashion instead of lumpsum investments.

- ULIP Plans -ULIP or Unit Linked Insurance Plans are a combination of an investment option and a life insurance. As the name ULIP suggests these are financial products that offer market-linked investment returns and life cover. If you want to take advantage of the benefits of both worlds of growth of wealth and life cover then you should go for ULIPs. Below are some of the funds available with Axis Max Life Online Savings plan – Axis Max Life UL Life Growth Super Fund Axis Max Life High Growth Fund Axis Max Life UL Life Growth Fund Axis Max Life UL Life Balanced Fund Axis Max Life UL Life Secure Fund Axis Max Life Dynamic Opportunities Fund Axis Max Life UL Money Market Fund

- Investment Plans -Investment Plans are financial tools that help create wealth for future. There are a lot of investment plans which will help you to invest your money into different market-lined and money-market products in a periodic fashion to achieve your goals. Investment plans do provide the advantage of maximizing our investments through systematic, long-term investments and create wealth for the future. The first step towards having the investment plan in India is to understand your risk profile and needs, and then choose an investment plan that best suits you.

- Pension Plans -Pension plans are financial instrument that are designed to accumulate wealth throughout their working years so that you can cater to your restatement needs. Pension plans are crucial for creating a robust retirement plan for a stress-free retirement.

- Retirement Plans -Retirement Plans are a type of life/annuity plan that are made to help you pay for things like medical bills and living expenses after you retire. You would want to continue living the same way after retirement. Both benefits plan and retirement plans are a classification of life coverage designs that are extraordinarily intended to meet your post-retirement needs. These plans help cover your expenses and ensure your future so you can enjoy your golden years financially independent.

- Endowment-Uniquely, an endowment policy includes a savings or investment component in addition to providing insurance coverage in the event of the policyholder's death. An endowment policy, in contrast to standard life insurance, is designed to double as an investment vehicle and a protection plan at the same time.

- NRI Investment Plans -No matter where family members live, NRI investment plans are a smart way to protect their finances. NRIs can invest in savings plans, unit-linked insurance plans, child plans, and retirement plans, among others, in India in addition to pure protection policies like term life insurance.

- Fixed Deposit -If you have to deposit a specific amount in advance for a fixed duration, Fixed Deposit or FD can be a great investment option. Banks offer a fixed rate of interest on your deposit amount depending on the tenure and applicable FD interest rates. To help you achieve your financial objectives over a period of time, secured investments provide investors with assured returns.

- Tax Saving Investments -Tax saving investments are investments through which you can save tax in India. There are various sections under the India Tax Act through which you can save tax by investing in various instruments such as life insurance, ELSS (Equity Linked Savings Scheme), PPF (Public Provident Fund), and Health Insurance.

Here is a list of tax saving investment options available in India–

| Investment options | Tax Benefit u/s |

|---|---|

| Life Insurance | Section 80C and Section 10(10D) |

| NPS Section | 80CCD |

| Health Insurance | Section 80D |

| ELSS (Equity Linked Savings Scheme) | Section 80C |

| PPF | Section 80C |

What is a Savings Calculator?

The savings calculator helps determine the rate at which your savings would grow over time. Most of the savings calculator online are related to certain savings and income plans. Based on your details, a savings calculator will help you estimate the growth of your savings. It helps individuals in planning for different financial goals in life.

Whether your goal is to achieve guaranteed savings or guaranteed income, you can use a savings calculator online to determine the assured returns under a specific savings plan. Before you start using a savings calculator, make sure you assess your financial needs, and decide on an amount you can save regularly.

How does a Savings Calculator work?

When you plan to save a certain amount regularly, you want to know the interest rate or returns you can get. This is what a savings calculator does – it tells you about the expected returns for a specific amount saved under a plan over a certain tenure. Various online savings calculators also provide the details of life cover component associated with the chosen plan, if any.

- Start using this savings calculator online by providing details, including your name, date of birth, gender, and annual income.

- Choose from the options of guaranteed savings, guaranteed income, or market-linked child plan given in this savings calculator.

- Enter the amount you can save monthly or annually under the plan selected.

- Select the plan tenure and benefit period as given in the savings calculator.

FAQs

1.Why should I use an investment calculator?

An investment calculator helps in making an informed decision to invest money in the right instruments. It also tells you about the impact of invested amount and investment period over the expected returns.

2.When should I start investing money?

There is no specific age to begin investing money. You can start your investment journey based on your current financial profile and life goals. Begin with using an investment calculator to know how to calculate return on investments.

3.Should I invest or save money for the future?

Investing money comes with greater risk but higher returns. However, you can save money in a low or zero-risk savings plan to get assured investment returns. If you are risk-averse, use a savings calculator online to find a suitable plan based on your needs.

4.What will happen if I invest money without using any investment calculator?

The risk of capital loss may increase if you do not make informed investment decisions. You can lower this risk by gaining knowledge about the risk-to-return ratio of different investment plans using investment calculators.

5.Are online ULIP calculators paid or free?

Most of the online investment calculators, including ULIP calculators, are available for use at no cost. It means you can easily use these investment calculators without worrying about paying money to access them.

6.What is a ULIP Calculator?

A ULIP calculator is an easy-to-use calculation tool designed to help you determine the maturity amount from a ULIP.

7.What is a Savings Calculator?

The savings calculator is a type of tool is designed to help you determine the maturity amount from a Savings plan.

8.What Does investing do?

Investing can grow your money, helping you meet your savings and investment goals. In addition to that, investing can also help you outpace inflation to reduce your financial burden in the future.

9.Are returns guaranteed under ULIPs?

No, returns in ULIP are not guaranteed, given that a proportion of the deposit is used to invest in market assets.

10.What is ULIP NAV?

NAV stands for Net Asset Value. NAV in ULIP indicates the market value of stocks held by the investor in the ULIP plan.

11.What are the advantages of using a Returns on Investment Calculator?

A return on investment calculator can help you calculate your returns easily. It’s easy to use, saves time, and gives you accurate results without any errors. You can plan your financial future better using a return on investment calculator.

12.Is it possible to withdraw ULIP?

ULIP comes with a lock-in period of 5 years. Withdrawals are not permitted before this duration.

13.How do we calculate return on investment?

Return on investment can be calculated using a return on investment calculator. You just have to fill in basic details such as investment amount, return rate, and investment tenure to calculate your returns.

14.How is my money invested in ULIP plans?

Individuals who are investing in ULIP plans are required to make regular investments into the scheme. A portion of this investment is used to buy investment assets that can offer returns according to their NAV. These investment assets include equity, debentures, and government securities.

15.How are the returns calculated in ULIP?

As ULIP provides market returns; hence returns in ULIP are not guaranteed. However, you can calculate your returns based on standard rate of performance at 4% and 8% of the fund with the help of a ULIP calculator.