Related Articles

What is GST: Full Form, Features & Components?

GST stands for Goods and Services Tax. It was introduced a new type of tax in India to replace a number of indirect taxes.....

Read More

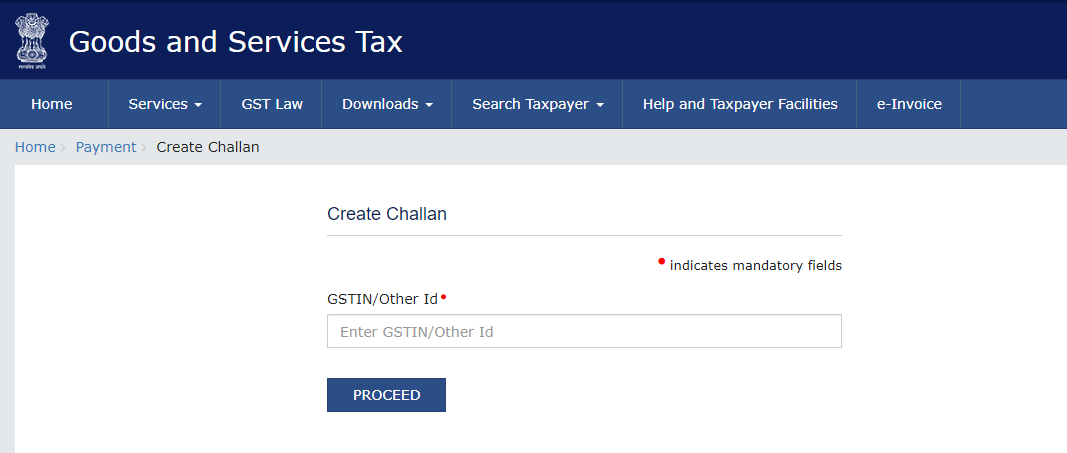

GST Payments: How to Create GST Challan and Pay Online

Any taxpayer who supplies goods or services will be required to make GST payments when their output tax liability is greater than their input tax liability. The online GST portal allows taxpayers to make these due GST payments through the creation of GST challans which can be paid through various online channels....

Read More

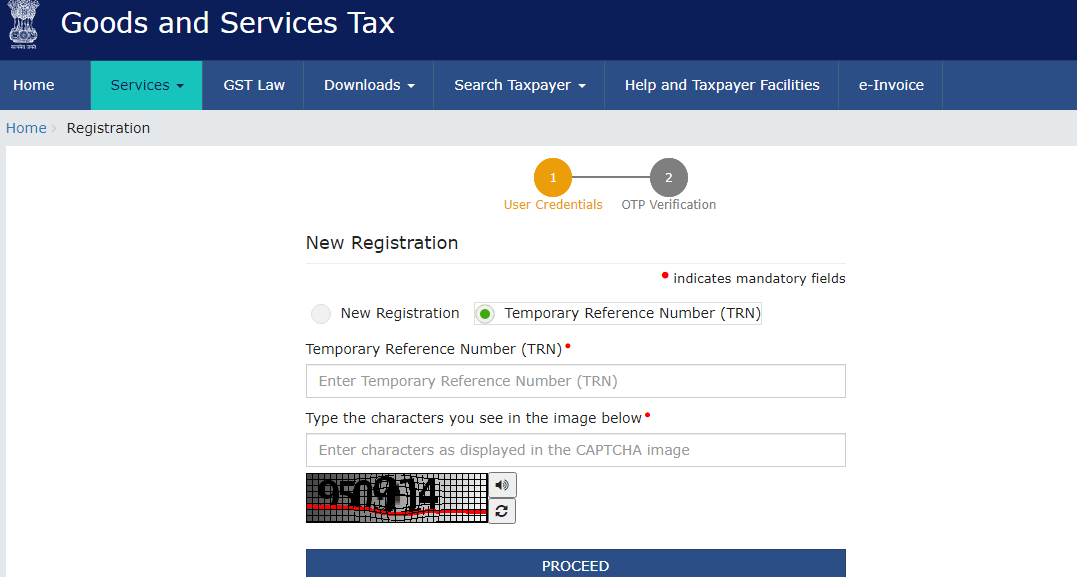

GST Portal Login Guide: A Guide to Take You Through the GST Registration Process

The Goods and Service Tax, commonly referred to as GST, came into effect on July 1st, 2017. The GST online portal is pivotal to implementation of this indirect tax regime....

Read More