What is Form 16: Eligibility, Significance, Format, and Issuance

Disclaimer

: In Unit Linked Policies, the investment Risk in the investment portfolio is borne by the policyholder.

Written by

Reviewed by

Sahil Rawal

BFSI Expert

Sahil Rawal is a digital & brand management specialist with over 10 years of experience in Financial Services Industry. Life insurance professional with expertise in digital marketing strategy, website content marketing and brand communication designed to increase brand awareness, drive engagement & sales.

Who Can Issue Form 16?

Form 16 in the income tax can only be issued by the employer. They must issue the certificate if taxes have been deducted from employees’ gross income, which is the individual’s total salary, without any tax deduction.

The Income Tax Act, 1961 mandates employers to provide Form 16 to employees who draw over ₹2.5 lakh as their annual salaries. This is because they may qualify to pay taxes.

Following are the situations under which the employer may not withhold TDS:

- The employee may not fall in the income tax slab on which tax is levied.

- Even though the individual may come in the taxable income slab, TDS may not apply because of certain tax benefits they are eligible for.

In any case, for those wanting to know what is the use of form 16, the answer is simple. Since the employer issues it, it serves as proof of them filing income tax returns to the government.

While it’s not mandatory to issue Form 16 to employees who don’t fall under the taxable income slab, several organizations give the certificate voluntarily. The practice only ensures clarity to the employee.

What is Form 16?

Form 16 is a key tax document for salaried taxpayers and it is issued by the employer every year. This annual tax certificate which contains tax deducted at source (TDS) source data needs to be issued by 15th June of the subsequent financial year. So Form 16 for FY 2021-22 would have to be issued by the employer on or before 15th June 2022.

Form 16 is issued as part of Section 203 of the Income Tax Act 1961. The also known as TDS certificate, it principally serves as proof of tax deducted from the employee’s salary so that relevant tax-saving benefits can be claimed at the time of filing income tax return. Note that the tax deducted is deposited directly with the government, along with the PAN card details of the taxpayer.

When is Form 16 Issued?

Since we now know what Form 16 means, let’s try to understand the timeline of the same.

Employers issue this TDS certificate by June 15 every year once the financial year during which the employee’s TDS was paid has ended.

Let’s understand this with an example, Mr. Arun Mittal received his Form 16, detailing income and deductions, for the financial year 2020-21, on or before June 15, 2021.

Eligibility Criteria for Form 16

Form 16 under income tax filing is vital for those whose salaries have been deducted at source. While it is not mandatory for all employees of the organization, let’s look at some pointers that will help us know who gets to receive form 16 every year:

- If you have tax deductions in your salary that your employer is paying to the government, you must receive your TDS certificate.

- If your income doesn’t fall in the taxable slab, but a TDS is being levied from the employer’s side, you must get your Form 16 so that you know the income tax refund amount that you can claim.

- You must get your tax document on or before June 15, after the financial year.

- Form 16 for income tax filing is issued irrespective of the company size. So, if you aren’t being issued your certificate, you can file a complaint against your company.

Significance of Form 16

Since we have a better understanding of what is form 16, let’s look at answering what’s the use of form 16.

The TDS certificate serves many purposes; let’s look at some of its many significant uses:

- It serves as income proof.

- Form 16 reflects the TDS on your salary for the financial year.

- You may require it if you are switching jobs. Some organizations require it for onboarding.

- It is an important instrument when filing income tax returns at the end of the fiscal year.

- The information on income and deductions recorded in Form 16 makes ITR filing easy without the help of an agent or CA.

- You can compare Form 16 to Form 26AS to verify the actual tax deposited.

- If you want to borrow a loan, the financial institution will check the form before initiating the process.

- The certificate is an important document for any foreign trip or visa application.

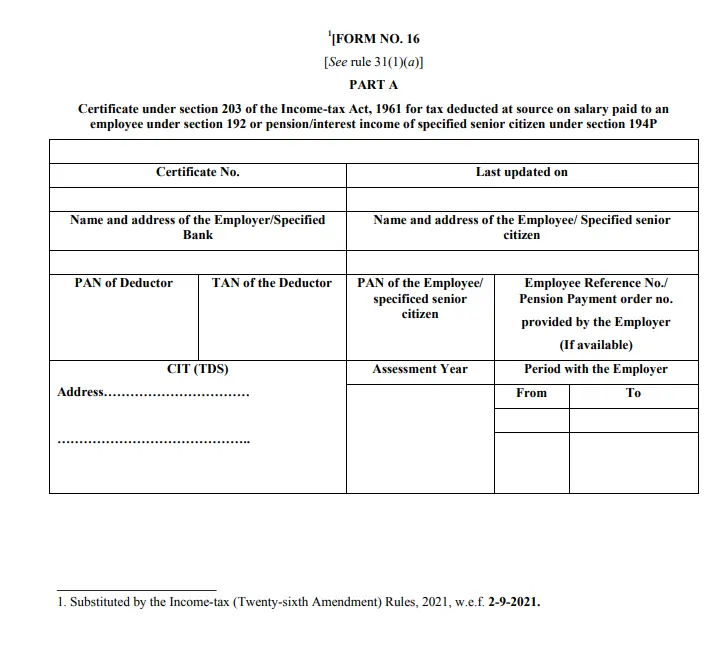

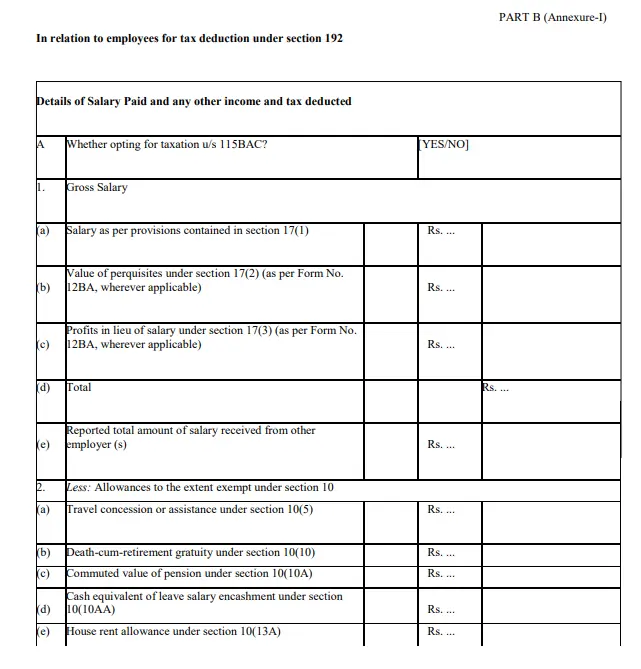

What is the Form 16 Format?

The Income Tax Form 16 features a pre-determined format that has been approved by tax authorities in India. Form 16 has two parts- Part A and Part B.

Part A contains details on tax deducted at source from the salary for the entire financial year. On the other hand, Part B contains of the tax paid such as TDS and advance tax paid to the government.

Let’s now look at the components of Part A of Form 16:

- Details of employee: PAN card, name, and address

- Employer’s name, TAN, and PAN numbers

- Tax deduction details for every quarter. It will also include bank details through which TDS was processed, dates of deposits, and other vital information.

- Details of the financial year

- Information on employee’s association with the employer

- Gross salary inclusive of basic salary, dearness allowance, PF contributions, house rent allowance, professional tax liability, and others.

- Any tax benefits

- Exemptions such as Section 80D health insurance tax benefits, HRA, conveyance, and others

- Due tax

- Total tax amount paid

- Tax amount still to be paid, if applicable

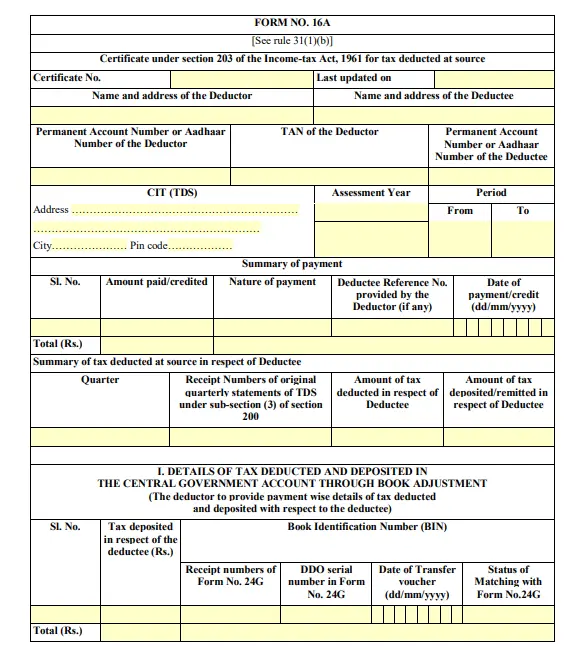

What is Form 16A?

A TDS certificate that is often confused with Form 16 is the Form 16A. However, while the Form 16 is only issued to salaried individuals, Form 16A can be issued to any individual tax payer. Form 16A can issued by different types of TDS deductors like banks, individuals, etc. TDS deductions that are recorded in Income Tax Form 16A include those for non-salary remunerations like TDS on fees for professional services, TDS on rental income, TDS on property transactions, TDS on recurring deposit/fixed deposit interest, etc.

Below is an example of what Form 16A looks like:

Key Differences Between Form 16 vs. Form 16A

Since, at this point, we are invested in knowing what is form 16, let us focus our attention on understanding the differences between Forms 16 and Form 16A.

The first thing to know about them is that they differ from Part A and Part B of Form 16.

Here are the details:

Form 16 Part A: It provides TDS details on income from freelancing, rent, interest on bank FDs, or any other income. It doesn’t give TDS details on salary.

Form 16 Part B: The tax deducted on the source during a property sale is presented in the form. The responsibility of the TDS deduction lies with the property buyer. They should deduct the TDS before transferring it to the seller. The amount deducted as TDS is deposited with the government. Form 16A on the other hand does not have any sub-parts.

Here are some primary differences between Form 16 in the income tax and 16A for better clarity:

| Form 16 | Form 16A |

|---|---|

| It is issued by an employer. | It is issued by banks, financial institutions, and others. |

| Form 16 means TDS deduction in salary. | This deals with TDS deduction on income other than salary. |

| It is issued annually. | It is issued after every quarter. |

| Form 16 of the income tax applies to salaried employees. | 16A applies to various type of individual tax payers. |

Conclusion

Now that you understand what is form 16 is and what’s form 16 used for, know that it’s important to check all the details mentioned under it before filing income tax returns. In case you find any discrepancy, reach out to the finance department of your organization and get it rectified.

FAQs

Can I file my income tax return without Form 16?

What will happen if I lose Form 16?

Who issues Form 16 of the income tax for a pensioner?

How are the details mentioned in Form 16 verified?

Is it necessary to attach Form 16 when filing income tax?

What if the employer doesn’t issue Form 16 to the eligible employer?

ARN: Aug23/Bg/04N

economictimes.indiatimes.com/wealth/tax/form-16-what-you-should-check-in-tds-certificate-while-filing-itr/articleshow/92274610.cms

economictimes.indiatimes.com/wealth/tax/what-is-form-16/articleshow/68387400.cms

www.forbes.com/advisor/in/tax/what-is-form-16/

groww.in/p/tax/form-16

www.etmoney.com/tax/form-16

www.maxlifeinsurance.com/blog/tax-savings/tds-on-rent

scripbox.com/tax/difference-between-form-16-and-16a/

Customer Reviews

Smart Wealth Plan

“I have taken Monthly Income advantage plan , ULIP Fast track Super plan and Smart Wealth plan from max life insurance company ....from which my family is safe and Secure..”

Manisha Deep Andola

Saving Advantage Plan

“I have invested in Max life cancer plan and Max life savings advantage plan. Both these plans are keeping me secured from illness and financial security”

Archana

Popular Searches

- Whatsapp: 7428396005Send ‘Quick Help’ from your registered mobile number

- Phone: 0124 648 890009:30 AM to 06:30 PM

(Monday to Sunday except National Holidays) - service.helpdesk@maxlifeinsurance.comPlease write to us incase of any escalation/feedback/queries.

- Whatsapp: 7428396005Send ‘Hi’ from your registered mobile number

- 1860 120 55779:00 AM to 6:00 PM

(Monday to Saturday) - service.helpdesk@maxlifeinsurance.comPlease write to us incase of any escalation/feedback/queries.

- 011-71025900, 011-61329950(9:30 AM to 6:30 PM IST Monday to Saturday)

- nri.helpdesk@maxlifeinsurance.comPlease write to us incase of any escalation/feedback/queries.

We would like to hear from you

Let us know about your experience or any feedback that might help us serve you better in future.

Do you have any thoughts you’d like to share?