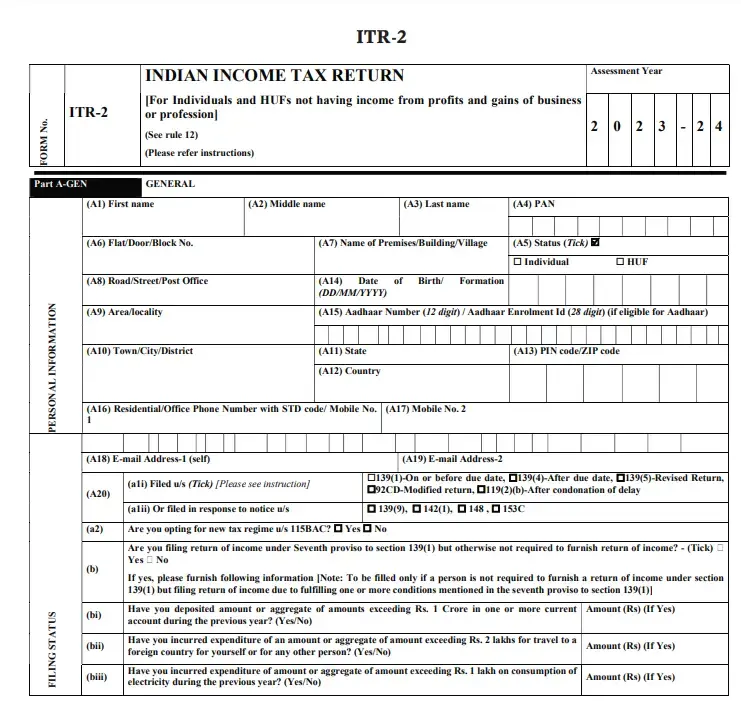

Income Tax Return Form 2 For FY 2022-23 & AY 2023-24

Since ITR forms can change from one year to the next, it is crucial to fill ITR 2 form for FY 2022-23 with precision to avoid any adverse consequences like a notice from the IT Department at a later date. Read on to know the details regarding eligibility for ITR 2 submission, different part of the ITR Form 2 and how to submit it online as well as offline.

Disclaimer:

In Unit Linked Policies, the investment Risk in the investment portfolio is borne by the policyholder.

Written by

Reviewed by

Sahil Rawal

BFSI Expert

Sahil Rawal is a digital & brand management specialist with over 10 years of experience in Financial Services Industry. Life insurance professional with expertise in digital marketing strategy, website content marketing and brand communication designed to increase brand awareness, drive engagement & sales.

What is ITR2?

ITR 2 means Income Tax Return Form 2. This income tax return form is only available for individuals and Hindu Undivided Families (HUFs) who do not have any income under the head “profits and gains from business or profession”, but are not eligible to file returns using ITR 1 Form (Sahaj).

So some examples of taxpayers who are required to file ITR 2 form for AY 2023-24 include:

Salaried taxpayers who hold the post of director with a listed or unlisted company

Individuals/HUF who have income under the head “capital gains”

Individuals/HUFs who have earned annual income in excess of Rs. 50 lakh for FY 2022-23

It must additional be pointed out that ITR Form 2 cannot be filed by individual or HUF taxpayers in AY 2023-24 if they have earned any income under the head “profits and gains from business or profession” during FY 2022-23.

Also Read: Income Tax Due Date Extension

What is the Structure of ITR 2 Form?

ITR 2 form is divided into different sections as below:

1) Part A of ITR 2: General Information containing personal data

2) Filing Status: Reason for filing such as filing before due date (Section 139(1)), delayed filing Section 139 (4), filing in response to IT department notice, revised return filing, etc.

3) ITR 2 Form Schedule S: Details of your income received as salary

4) ITR 2 Form Schedule HP: Details of your income received from one or more house property (taxpayer also needs indicate ownership of the property)

5) ITR 2 Form Schedule CG: Detailed computation of your income from capital gains (from sale/transfer of various types of capital assets, including long-term and short-term capital gains)

6) ITR 2 Form Schedule 112A & Schedule 115AD(1)(b)(iii)-Proviso: Income from sale of equity shares in a company or unit of equity oriented fund or unit of business trust on which STT is paid u/s 112A or Schedule 115AD(1)(b)(iii)-proviso, as per applicability

7) ITR 2 Form Schedule VDS: In this section the filer needs to provide details of capital gains obtained from sale of any virtual digital assets like cryptocurrency, non-fungible tokens (NFTs) made in FY 2022-23

8) ITR 2 Form Schedule OS: Details of computation of your earnings under the head “income from other resources” such as rental income from machinery, buildings, and lottery

9) ITR 2 Form Schedule CYLA: Statement of your income after setting off current year’s losses

10) ITR 2 Form Schedule BFLA: Details of income after setting off brought forward losses of previous years

11) ITR 2 Form Schedule CFL: Details of losses that are being carried forward to following years

12) ITR 2 Form Schedule VIA: All deductions under chapter VI-A this section further contains 2 tables. Table 1 Part B contains details of deductions including Section 80C, 80CCC, 80CCD, 80D, 80E, 80G, 80GG, etc. Whereas Table 2 Part C, CA and D contains details of other deductions like 80QQB, 80TTA and 80TTB, 80U, etc.

13) ITR 2 Form Schedule 80G: All details of donations made in a year entitled under section 80G

14) ITR 2 Form Schedule 80GGA: All details of donations for rural development or scientific research only

15) ITR 2 Form Schedule 80D: Deductions with respect to health insurance premium u/s 80D for self, dependent family members and parents including senior citizen parents are to be provided here.

15) ITR 2 Form Schedule AMT: Detailed computation of alternate minimum tax payable under section 115JC

16) ITR 2 Form Schedule AMTC: Detailed calculation of tax credit under section 115JD

17) ITR 2 Form Schedule SPI: Income of specified people (minor child, spouse, or similar) included in the total income of the assessee under section 64

18) ITR 2 Form Schedule SI: Income which is liable to be taxed at special rates

19) ITR 2 Form Schedule EI: All details of income that is exempt from tax

20) ITR 2 Form Schedule PTI: Pass through Income details from business trust or investment fund u/s 115UA and 115UB

21) ITR 2 Form Schedule FSI: Statement of income accruing or arising outside India

22) ITR 2 Form Schedule TR: Entire summary of tax relief claimed under tax paid in countries other than India

23) ITR 2 Form Schedule FA: All details of foreign assets and income from any sources obtained from a country other than India

24) ITR 2 Form Schedule 5A: Information regarding income apportionment between spouses being under the Portuguese Civil Code

25) ITR 2 Form Schedule AL: Details of movable/immovable asset and liability at the end of FY 2022-23 for taxpayers with income exceeding Rs. 50 lakh during the year. This section should include details of assets like residential/commercial property, jewellery, bullion, bank deposits, insurance policies, loans and advances, etc.

26) ITR 2 Form Schedule Tax Deferred on ESOP: Information regarding deferment of tax payable on Employee Stock Options/sweat shares received from an eligible employer

27) Part B-TI: Computation of Total Income from various income sources

28) Part B-TTI: Computation of tax liability on Total Income

29) TRP Details: This section will include relevant details of a Tax Return Preparer (TRP), if the filing is done with assistance of a TRP.

30) Item No 20 – Tax payments

IT 2 Form – Item no 20 - Part A – All details of payments made under advanced tax or self-assessment tax

IT 2 Form – Item no 20 - Part B – TDS on salary details

IT 2 Form – Item no 20 - Part C – TDS (tax deducted at source) details on income other than salary

IT 2 Form – Item no 20 - Part D – TCS (tax collected at source) details during FY 2022-23 as mentioned in form 27D

31) ITR 2 Form- Verification – Enter details for verification as per given specifications (return of income verified by individual taxpayer or by Karta of HUF)

Who is Eligible to File ITR 2 Form?

ITR 2 or Income Tax Return Form 2 can be used by individuals and HUFs who are not eligible to file using ITR Form 1 due to any reason. However, such Individuals and HUFs can file ITR 2 only if they have not received any income under the head “Profits and gains from business or profession” during FY 2022-23.

So, if you have income from the following sources, you must file ITR-2:

1) Salary/pension income

2) Income from one or more house property

3) Income from short-term/long-term capital gains or losses from the sale of property or investment

4) Income from other sources except salary like lottery, different legal meaning of gambling, bets on horse races

5) Agricultural income of more than Rs. 5000

6) Having foreign income or holding overseas assets

7) Income from capital gains from sale of virtual digital assets like non-fungible tokens (NFTs), cryptocurrencies like bitcoin, etc.

Other criteria for filing ITR 2 in AY 2023-24 include the following:

1) Non-resident or a resident not ordinarily resident taxpayer

2) Directorship of listed or unlisted company

3) Holding investments in unlisted shares of one or more companies

Who is Not eligible for filing ITR 2?

Taxpayers are not eligible to file ITR 2 if they meet one or more of the below criteria:

1) Individual or HUF having income under the head “profits and gains from business or profession” during FY 2022-23

2) Individuals and HUF eligible for filing ITR Form 1 (Sahaj) for AY 2023-24.

How to File ITR 2?

You can file ITR Form 2 online as well as offline. For ITR 2 download, you can visit official website of the income tax department.

How to File ITR 2 Offline?

How to File ITR 2 Offline?

1) Only individuals above 80 years or more can file ITR 2

2) ITR 2 can be filed by furnishing a return on a physical paper form at your nearest IT office

3) ITR 2 can be filed by furnishing a bar-coded return at your nearest IT office

The income tax department will issue an acknowledgement slip after completion of the submission process.

How to File ITR 2 Online?

How to File ITR 2 Online?

ITR 2 download can be carried in case of individuals and HUFs not having income profits and gains of business or profession. Proceed with ITR 2 download and follow these steps:

1) Furnish the return online / electronically with your digital signature

2) Transmit your data electronically

3) Submit verification for ITR-V

After the completion of ITR Form 2 download and its electronic submission, the acknowledgement will be sent to your registered email address. It is also available for download on the official website of income tax.

Sign the acknowledgement of ITR 2 and send it to the office of CPC in Bangalore within 120 days of filing ITR 2 form online. Do not attach any documents.

Significant Changes Introduced in ITR 2 for AY 2023-24

Below is a list of the key changes that have been made to the Income Tax Return form 2 for AY 2023-24:

1. New field has been inserted – “Whether you are FII/FPI?”. Those answering yes that they are a foreign institutional investor (FII) or foreign private investor (FPI) will need to provide relevant SEBI (Securities Exchange Board of India) registration number

2. In salary schedule of ITR 2, new field for relief under Section 87A has been added.

3. ITR 2 for FY 2022-23 also features 3 new fields in the Schedule CG this year:

a) Short term capital gains amount deemed to be long-term capital gains

b) Income from transfer of virtual digital assets

c) Income chargeable under the head “Capital Gain” (Sum of above inputs)

4. Schedule TCS (tax collected at sources) has been revamped to include claiming of brought forward TCS and for carrying forward TCS

5. Schedule VDA has been added to include details of income from transfer of virtual digital assets

6. Schedule VI A of ITR 2 for AY 2023-24 now allows input of details of deduction under Section 80CCH

7. A new field has been inserted in Schedule 80G where the tax payer can provide donation reference number

8. Schedule Part B TI for ITR 2 features a new field “Capital Gains chargeable @30% u/s 115BBH”. This refers to the capital gains tax payable on transfer of virtual digital assets during FY 2022-23.

Special Instructions to File ITR 2 Form

1. For schedule not applicable to you – strike or mention NA

2. Indicate nil figures with ‘Nil’

3. Place hyphen (–) before negative figures

4. Round off all figures to nearest one rupee except for losses, total income, or tax payable

5. For individuals under ‘Employer’ category, mark ‘Government’ for central / state government employee; else mark ‘PSU’ for public sector company

FAQs About ITR 2

Q. Can I file ITR 2 when I have sold my housing property?

Q. What qualifies as an exempt income for filing ITR 2?

Q. What is the Process for ITR 2 Form Download?

Q. What are Capital Assets Under ITR 2?

ARN: June23/Bg/27B

Source:

https://www.incometaxindia.gov.in/Pages/downloads/income-tax-return.aspx

https://www.incometaxindia.gov.in/forms/income-tax%20rules/2020/itr2_english.pdf

https://www.policybazaar.com/income-tax/itr2-form/

https://cleartax.in/s/itr2/

https://cleartax.in/s/itr2/

https://incometaxindia.gov.in/Supporting%20Files/ITR2023/Instructions_ITR2_AY_2023_24.pdf

https://economictimes.indiatimes.com/wealth/tax/who-can-file-income-tax-return-using-itr-2-form/articleshow/93156156.cms

Popular Searches

- Whatsapp: 7428396005Send ‘Quick Help’ from your registered mobile number

- Phone: 0124 648 890009:30 AM to 06:30 PM

(Monday to Sunday except National Holidays) - service.helpdesk@maxlifeinsurance.comPlease write to us incase of any escalation/feedback/queries.

- Whatsapp: 7428396005Send ‘Hi’ from your registered mobile number

- 1860 120 55779:00 AM to 6:00 PM

(Monday to Saturday) - service.helpdesk@maxlifeinsurance.comPlease write to us incase of any escalation/feedback/queries.

- 011-71025900, 011-61329950(9:30 AM to 6:30 PM IST Monday to Saturday)

- nri.helpdesk@maxlifeinsurance.comPlease write to us incase of any escalation/feedback/queries.