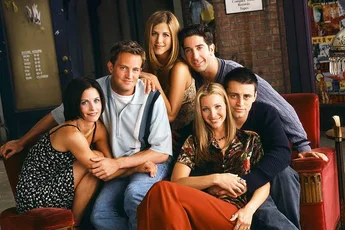

There are average sitcoms, funny sitcoms, original sitcoms, and then there is FRIENDS! First aired almost 25 years ago, the affably funny TV show is a modern-day masterpiece – inspiring an entire generation to sit back and relax, with a cup of coffee in hand.

Set in the 90s, FRIENDS is a story of six good-looking New Yorkers, who deal with life’s problems in their inimitable way. Without doubt, the quirky one-liners and the ruthless comebacks from the show’s cast have taught us more about life, money, love, and struggles than any book ever could.

Many of us who have seen FRIENDS, look up to the group for dating advice (Of course, not from Joey), and tips on how to laugh away life’s miseries with sarcasm (Chandler, you’re the man!). And yes, we have learned quite a lot about finances from these misfits of the Central Perk. To honour the value of friendships and living life to the fullest, here we are – looking at our favourite quirky six friends and essential financial lessons that they teach us.

‘Always Prepare for the Worst – Monica Geller Bing

(Image source: https://m.media-amazon.com/images/M/MV5BNTRhYjNjODgtMGVjNi00YjdhLWI1MWYtNTE2YjM0NGMzZDFiXkEyXkFqcGdeQXVyNjUxMjc1OTM@._V1_QL50_SY1000_CR0,0,1658,1000_AL_.jpg)

Perhaps the most organized and mature person in the group, Monica (or Courtney Cox) was often perceived as a control-freak in the show. However, there are several instances when Monica loosened up briefly to show her playful boisterousness.

Things turned south when Monica had to lose her chef’s job due to an unstated workplace policy that discouraged taking bribes. While she wouldn’t have accepted the gift of eggplant and five steaks had she known about the policy, it was shocking to see her lose the job that she loved, in such manner.

Monica wasn’t prepared financially to lose her job and did not save enough for a financial crisis or even her marriage.

Seeing Monica’s plight, it becomes evident that we should always prepare ourselves for the worst. Emergencies can come up anytime – so you must ensure that you are well-equipped, both mentally and financially, to deal with the situation. For this, you need to work towards creating an emergency fund, by putting aside a portion of your savings.

‘Never Shy Away from taking a Risk’ – Chandler Bing

(image source: https://m.media-amazon.com/images/M/MV5BMzQyZTIxODktYWFhMS00Y2U1LWFiNTQtZjUxNTk2YmM0NzJiXkEyXkFqcGdeQXVyNTM3MDMyMDQ@._V1_QL50_.jpg)

Not only was Chandler Bing funny – his outrageously sarcastic one-liners set the benchmark when it came to hilarious quips. Although Chandler (played by Matthew Perry to perfection) worked a typical 9-5 job, none of his friends knew what he did for a living.

Chandler himself did hate his job but persisted with it because the paycheck was large. However, in his mid-30s, Chandler finally left his job to pursue a career in marketing – as an intern. This was a bold move, but as the show progressed, we know that Chandler finally got the ending he always wanted.

Chandler’s journey tells us that it is crucial to take risks in life, especially when it comes to financial sustenance. While investing, taking calculated risk always yields better results in the long run. You must put your savings into high-performing equity options to earn substantial returns. At the same time, you need to make sure that you avoid putting all your money into one investment option.

‘Follow Your Dreams’ – Ross Geller

Image source: https://m.media-amazon.com/images/M/MV5BNTUwMTMwMjg4Ml5BMl5BanBnXkFtZTgwODA3MzE1NTE@._V1_QL50_.jpg

In the case of Ross Geller (played by the ever-fluent David Schwimmer), we can safely say that persistence pays-off. Being a ridiculed but highly intellectual paleontologist, Ross had been the embodiment of the quintessential nerd, who’s after the love of his life, but is too afraid to ask.

However, he was never in a rush to accomplish his goals. Instead, he was persistent in his efforts and never backed away from following his dreams – whether it was proposing to Rachel or taking up a teaching job at the NYU.

Ross’s journey through the show inspires us that it always pays to have a plan ready for the future,and you should continually work towards it. Like Ross, you can also achieve your goals, no matter how seemingly impossible they seem – provided you are persistent with your efforts.

‘Your spending’s should not exceed your earnings’ – Joey Tribbiani

Image source: https://m.media-amazon.com/images/M/MV5BNTk3MzIzMWUtZTYzMC00YTYxLTg0MjUtNDFkYWRlY2Y4MjdlXkEyXkFqcGdeQXVyNTM3MDMyMDQ@._V1_QL50_.jpg

Who doesn’t love Joey? From his wickedly charming good looks to his effortless ‘How you doin?’,Joey (played by the suave Matt LeBlanc) was perhaps the most likable character on the show. Joey was always between acting jobs – getting his big breakthrough ‘Days of Our Lives’and then unceremoniously got thrown out of the same.Between all this, his constant emotional and financial support was Chandler. But Joey had this habit of going all-in when it came to spending money. As a result, he as always left with a lot of debt and no savings.

What Joey teaches us is that it is never a good idea of overspending and incurring debt. When it comes to personal financial planning, it is crucial that you understand the pitfalls of lifestyle inflation. By virtue of life inflation, as your income increases,your spending increases too. However, it is prudent that you always keep a check on your expenses andput the additional money into a savings plan.

‘Life is All About Hustle’ - Phoebe Buffay

(image source: https://m.media-amazon.com/images/M/MV5BYjJlYzY2ZGMtNTA3YS00NDU0LTljMzAtZGE4MzI3ZTMxMTBkXkEyXkFqcGdeQXVyMzU0NTc0MDY@._V1_QL50_.jpg)

Inarguably, Phoebe is one of the most-weirdest characters we have ever seen in a sitcom; it is endearing to see that she always speaks her heart out and stands her ground. No matter how weird her perspective was, she always backed her instincts with her eccentricities. Like Joey on the show, Phoebe too didn’t have a stable career or job. From being a masseuse to a performer at the Central Perk with an absurd singing, Phoebe was always making sure she had more than enough money on her. In other words, Phoebe was all about the hustle – working hard to have an extra income source in place.

Be Independent – Rachel Green

https://m.media-amazon.com/images/M/MV5BODM1NTkzNjgwMV5BMl5BanBnXkFtZTgwMTgzMzYzMzE@._V1_QL50_.jpg

Rachel Green (portrayed by the beautiful Jennifer Aniston) might be the ‘Daddy’s little rich girl,’ her growth over the show has been one of the most endearing. In the first season of FRIENDS she was this self-centered spoilt girl who looked up to her affluent parents for everything. As the seasons progressed, however, we saw Rachel transform into an independent woman – working her way up from a waitress’ job to the office desk at Bloomingdales and then at Ralph Lauren. Her character development cherishes financial independence in the best way possible on the show.

Your Personal Financial Planning is Always “There for You”!

Arguably, FRIENDS is one show for all ages. While each character holds a special place in our hearts, their story together makes it a great learning experience. With FRIENDS re-runs on the cards, our weekends are sorted; their mannerisms and quotes are a part of our communication,and each story arc is itself a learning curve for us.

There are several things FRIENDS taught us. For example, Rachel’s growth as a strong, financially independent woman inspires us to value career growth and personal financial planning. On the other hand, Ross’ caring nature inspires us to keep friends and family close. The most important lesson from FRIENDS, however, is that despite all odds, real friends always stick together.

Personalized insurance and investment plans from Max Life Insurance, too, help you ride out life’s uncertainties with ease and never let financial instability creep in. These plans help you combine insurance benefits with financial planning; thus, ensuring that you have the control of your life and finances in your hands and live a lie on your terms. Or, as they say in FRIENDS, your financial planning will always be “There for You!”

ARN:- 23122019/KC14