Written by

Updated :

Reviewed by

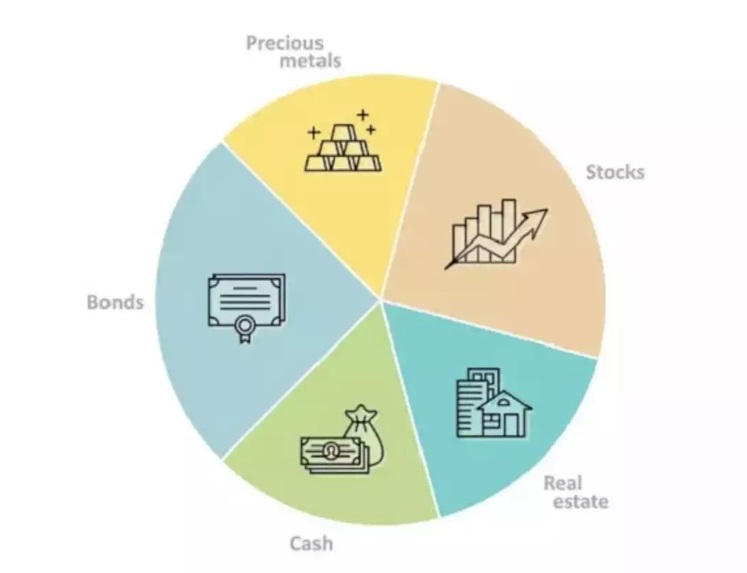

Multi-asset allocation funds offer investors a combination of debt, equity, and one other asset class like real estate, gold, etc. in a single investment. What’s more these schemes employs different asset allocation strategies designed to adapt to changing market conditions. These features give this type of mutual fund the potential to provide optimal risk-adjusted returns to investors. Read on to know details about multi-asset allocation funds, their features, benefits and if they are a suitable investment for you.

What are Multi-Asset Allocation Funds?

As the name indicates, multi-asset allocation funds invest in a mix of asset classes and help in diversifying investments to manage investment risk more efficiently. The allocation of assets and the related composition will differ across investors. This asset allocation is constantly tracked and adjusted by the fund managers depending on the economic indicators and market trends.

The impact of volatility can be easily mitigated via diversification. As per the SEBI (Securities and Exchange Board of India) regulation, the minimum percentage that a multi-asset fund must invest in three asset classes is 10%. Individuals, after investing in a multi-asset fund, come across a unique combination of asset classes. They do not have to conduct research and look after individual investments.

Such type of fund intends to bring together the hedging benefit of gold investments, stability of fixed earnings, and equity’s growth potential in a single professionally-managed portfolio. It helps in curbing the volatility in returns and boosts the overall investing experience.

Features and Benefits of Multi-Asset Allocation Funds

Here are the notable features and benefits of the Multi-asset allocation funds:

Diversification

The multi-asset allocation fund allows investors to allocate assets across different asset classes. This ensures diversification, which helps investors get away with market volatility and minimise investment risk. In addition, investors can secure their portfolio from the risk of depending only on one asset class and derive stable income.

Risk management

The success of investment depends on how effectively investors manage risk, and investing in multi-asset allocation funds will help investors efficiently manage risks. As the investment is made across varied asset classes, the risks related to market fluctuation can be managed better with superior downside protection. The portfolio can be made resilient once a proper balance between volatile and stable assets has been maintained.

Flexibility and adaptability

Another notable advantage of the multi-asset allocation funds is that it bestows investors with the utmost adaptability and flexibility. As investors can rebalance the asset allocation as per the emerging scopes or for dodging the risks, they can make the most of these funds. It helps to align the portfolio in a way that caters to the investment goal of the investor and the ever-changing market landscape. Investors must have a deep insight into what asset allocation is, benefits and strategies involved in it. This helps them choose suitable investment options.

Professional expertise

The multi-asset allocation funds are managed by investment professionals who have experience in analysing and opting for assets. These professionals have deep market insights. Hence they can make apprised investment decisions and help investors efficiently manage the fund.

Portfolio rebalancing

The multi-asset allocation fund also features automatic portfolio rebalancing, which helps investors make sure that the investments made across different asset classes are well distributed. This helps in generating higher returns. Through asset allocation and rebalancing as per changing market conditions, investors can sail through the market’s ups and downs.

Unrestricted entry and exit

With the multi-asset allocation fund, investors do not have to pay any amount to enter and exit the scheme subject to applicable terms and conditions. These mutual funds allow investors to redeem 10% or less of their initial investment before 1 year without any exit load. If more than 10% of the units allotted are redeemed in one year, investors will have to bear an exit load. However, if the investment is redeemed after one year or more, investors do not have to pay any exit load.

Ready-made portfolio

Creating a tailor-made investment portfolio is not easy for maximum investors to afford as it involves the assistance of a professional. However, with multi-asset allocation fund investment, investors can avail of a customised investment portfolio besides reaping the benefits of a well-balanced risk and reward investment option.

Related Articles

- Benefits of ULIP Investment Plan

- Types of ULIPs

- How to Save Tax with ULIPs

- Maximize Returns With ULIPs

- Best Short Term Investments for Tax Saving

- What is Power of Compounding

- What is Investment

- Types of Investment in India

- 80C Investment Options

- Fixed Deposit Interest Rates

- Voluntary Provident Fund

- Difference Between Saving And Investing

- What is Fixed Deposit

- What is Term Deposit

- What is Recurring Deposit

- Fixed Deposit vs Recurring Deposit

- What is KYC

- Max Life Guranteed Income Plan

- What is ULIP

Limitations of the Multi-Asset Allocation Funds

Though the risks or limitations related to multi-asset allocation funds are not very significant. However, if the asset has not been properly allocated, it will result in lower profitability. In addition, the multi-asset fund will not yield higher returns if invested in the short term. In order to enhance profitability, it is advised to go for a medium to long-term investment horizon.

If the investors do not want to take higher risks, then they should not invest in a multi-asset fund that has higher exposure toward equities. Investors must know about the taxation of the fund where they are choosing to invest. This will help investors avoid last-minute hassles.

Taxation of Multi Asset Allocation Fund

The multi-asset allocation fund is subjected to taxation as per applicable rules of mutual fund taxation. All mutual funds dividends are considered part of income and are therefore taxed under the income tax slab rate that the investors fall under. If the holding period of the fund is less than three years, investors will have to pay tax on the short-term capital gain. If the holding period is more than three years, investors will be charged 20% with indexation on the long-term capital gain.

The taxation of multi-asset allocation fund capital gains is based on equity exposure. The multi-asset fund scheme will be subjected to taxation like an equity fund if the exposure of the equity exceeds 65%. If it does not exceed 65%, then the scheme will be taxed like a debt fund.

Who Should Invest in a Multi-Asset Allocation Fund?

Investors with moderate risk appetite must go for investing in multi-asset allocation funds. This type of mutual fund proves to be a good choice for investors who are seeking to diversify their portfolio upon gaining access to different asset classes. In addition, it proves to be a perfect choice if investors wish to opt for a fund that comes with less risk capital appreciation.

It is very important for the investors to analyse the underlying investment strategy. This will help them opt for the right fund depending on their risk appetite and liquidity requirements.

Multi-asset allocation funds are highly preferred by those who intend to be equipped with a long-term and all-purpose investing solution, which bestows investors with downside risk. Investors can ensure an enhanced and well-diversified portfolio by investing in this fund. Investors with years of experience in portfolio rebalancing and allocation of assets can easily make the most of multi-asset funds and boost returns.

Related Articles

- Benefits of ULIP Investment Plan

- Types of ULIPs

- How to Save Tax with ULIPs

- Maximize Returns With ULIPs

- Best Short Term Investments for Tax Saving

- What is Power of Compounding

- What is Investment

- Types of Investment in India

- 80C Investment Options

- Fixed Deposit Interest Rates

- Voluntary Provident Fund

- Difference Between Saving And Investing

- What is Fixed Deposit

- What is Term Deposit

- What is Recurring Deposit

- Fixed Deposit vs Recurring Deposit

- What is KYC

- Max Life Guranteed Income Plan

- What is ULIP

Frequently Asked Questions (FAQs)

Q. Are Multi-Asset Allocation Funds the same as Dynamic Asset Allocation Funds?

No, they are two different types of hybrid mutual funds. Multi-asset allocation funds have greater flexibility when changing their portfolio allocation as compared to dynamic asset allocation funds.

Q. Can I invest in gold using Multi-Asset Allocation Funds?

Yes, a majority of multi-asset mutual funds invest in gold investment options like gold ETFs or gold funds. However, the proportion of gold in the portfolio of these schemes is liable to change depending on fund manager’s convictions and changing market conditions.

Q. How to invest in multi-asset schemes in India?

Like other types of mutual funds in India, both lump-sum investments and systematic investment plan style investments are allowed in multi-asset allocation funds. Additionally systematic withdrawal plans and systematic transfer plans are also allowed in the case of these schemes.

Q. Are there tax benefits of investing in multi-asset funds?

No, currently equity linked saving schemes are the only category of mutual funds that offer an investment benefit under Section 80C investment options. Multi-asset allocation funds do not qualify for this benefit.

Q. Is it possible to lose money by investing in multi-asset allocation funds?

Yes, you can lose money by investing in multi-asset funds. While these schemes offer superior risk management as compared to many other types of mutual funds, there is still some investment risk. This is because these scheme invest in market-linked instruments, as a result, returns from this investment are not guaranteed and the principal amount invested is also at risk.

Sources:-

https://www.livemint.com/money/personal-finance/why-multi-asset-allocation-fund-should-be-a-part-of-your-portfolio-11684647503224.html

https://groww.in/p/hybrid-funds/multi-asset-allocation-funds

https://cleartax.in/s/best-multi-asset-allocation-mutual-funds

https://upstox.com/learning-center/mutual-funds/what-is-multi-asset-allocation-funds-in-india-meaning-benefits/

ARN No : October23/Bg/25A